Legislative Updates

Week of February 23, 2026

Children and Families

The Ohio Department of Children and Youth reported sustained review activity tied to a growing number of program integrity referrals within child care and youth service programs. Increased program participation statewide has coincided with strengthened oversight expectations, resulting in expanded monitoring and investigation processes. State officials emphasized that these efforts are intended to preserve program quality, ensure appropriate use of public resources, and maintain access for eligible families.

District Advocacy Position

Support continuation and expansion of early childhood and family stabilization programs serving high-need communities

Advocate for review processes that are efficient, transparent, and minimally disruptive to eligible families

Encourage proactive communication between state agencies and school districts regarding service interruptions that may influence attendance, behavior, and readiness indicators

Promote formal district representation in policy discussions affecting child care and youth service administration

Interagency System Coordination

State messaging reinforces an ongoing priority to strengthen coordination among education systems, children and youth agencies, and related public service entities. Efforts continue to focus on improving alignment of service delivery, expanding data visibility across agencies, and reducing fragmentation in supports provided to children and families. The direction of this work reflects recognition that isolated interventions are insufficient to address complex barriers affecting student success.

District Advocacy Position

Advance integrated student support models linking schools with health, mental health, housing, and family service partners

Support development of interoperable data systems that respect privacy while enabling timely service coordination

Advocate for funding structures that incentivize cross-agency collaboration rather than siloed program implementation

Encourage regional governance or convening structures that include school district leadership in system-level planning

Leadership Implications

The update collectively illustrates a policy environment characterized by expanding expectations for accountability and collaboration across child-serving sectors. For school system leaders, these dynamics translate into increased need for partnership management, policy awareness, and advocacy engagement at the state level. District leadership must navigate the intersection of education policy, social services infrastructure, and fiscal stewardship while maintaining focus on instructional improvement.

District Advocacy Position

Continue engagement with statewide leadership associations to shape policy implementation

Advocate for resources supporting district capacity to coordinate external partnerships

Promote recognition of school districts as central conveners within local child-serving ecosystems

Encourage legislative understanding of the operational realities faced by high-poverty districts

Closing

A continuing evolution toward integrated accountability and service delivery across systems serving children and families exists. For districts operating within complex socioeconomic contexts, these policy movements are consequential and warrant sustained attention.

Strategic advocacy should emphasize preservation of access for vulnerable families, practical implementation frameworks, and formal inclusion of district leadership in cross-agency decision-making.

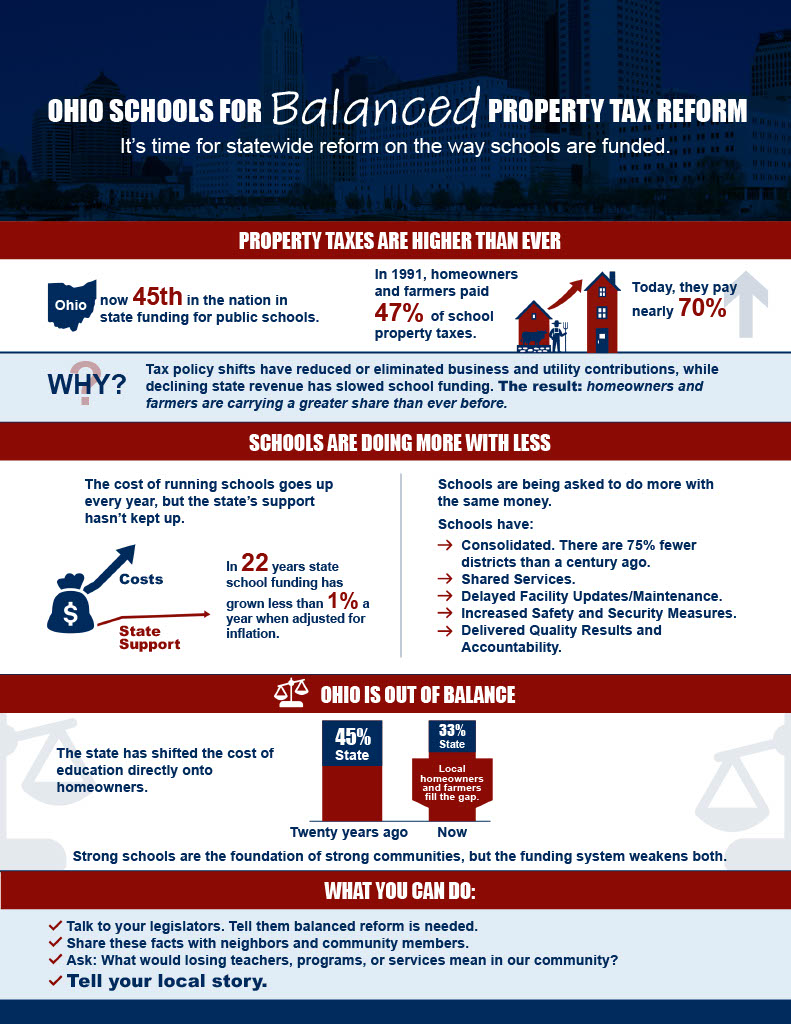

Ohio Schools for Balanced Property Tax Reform

Families across Ohio deserve relief from rising property taxes, and communities deserve strong schools, safe neighborhoods, and reliable public services. Achieving both is possible, but only if the responsibility is shared fairly among families, local governments, businesses, and the state.

The Springfield City School District recognizes that change is necessary, and our team is committed to being part of the solution. However, reforms must be balanced to protect both taxpayers and the future of public education.

What happened?

State Policy Shifts

Over time, state-level decisions have placed greater reliance on local property taxes to fund schools.School District Actions

Districts have already implemented consolidations, shared services, and efficiency measures to reduce costs while protecting student learning.Changing Tax Burden

The balance has shifted significantly: homeowners and farmers now pay nearly 70% of school property taxes, compared to just 47% in 1991. Businesses, by contrast, carry a far smaller share than they once did.Community Actions

Residents can play an important role by:Talking directly with legislators about the need for fair reform.

Informing teachers and staff about the impact of state policy changes.

Engaging neighbors and community members in conversations about equity.

Advocating for solutions that ensure schools remain strong and property tax reform is balanced.

Ohio Schools’ Commitments

Transparency

We will continue to be clear about where funding comes from and how it is spent, ensuring accountability to taxpayers.Empathy

Property taxes feel high because they are high—homeowners and farmers are paying more than ever before.Partnership

We support reforms that relieve families while also ensuring strong schools and safe, thriving communities.

Key Point

Unlike those who blame schools for rising property taxes, Ohio schools are allies of taxpayers. State-level tax policy changes have shifted the burden dramatically: homeowners and farmers now carry nearly 70% of the load—the highest in state history.

Balanced reform is necessary. Families deserve relief. Schools and communities deserve stability. Together, both are possible.

The Myth of Exploding School Budgets

Despite what you may hear, school funding hasn’t exploded. In fact, over the last 20 years, schools have been asked to take on significantly more, from advanced technology to safety upgrades to expanded student support, but the funding to pay for these initiatives has barely budged. When you adjust for inflation, state revenue per student has only grown by a fraction of a percent each year. Schools are being asked to do a lot more with essentially the same resources.

State revenues have not kept pace.

From 2000 to 2022, overall state revenue actually decreased by 2.2% after inflation.

On a per student basis, state revenue grew just 6.6% over 22 years — that’s only about 0.3% a year.

➡️ In other words, state funding for each student has been essentially flat for two decades.

School spending increases look big until you break them down.

Overall, school spending rose 9.4% over 22 years — that’s only 0.43% a year after inflation.

On a per-student basis, spending grew 19.4% over 22 years, or about 0.88% a year after inflation.

➡️ Less than 1% growth per year is hardly the “massive increase” some claim.

Expectations have skyrocketed while funding hasn’t.

Schools are asked to provide far more today than in 2000: new technology, safety measures, mental health supports, career readiness pathways, and more.

Yet the dollars to support those responsibilities have stayed nearly flat.

How to Advocate

Contact your legislators about the need for balanced reform.

Ask: What would losing teachers, staff, or programs mean for our community?

Share this information with neighbors, friends, business leaders, and community groups to amplify Springfield’s voice.

Moving Forward

Springfield’s students deserve stable, equitable resources that reflect today’s educational costs and community priorities. Thoughtful tax reform is welcome; unfunded mandates are not. By engaging legislators now, residents can protect instructional quality, public safety, and the economic vitality of the entire city, today and for generations to come.

Links

Questions?

Send the SCSD an email at:

How You Can Help

Leverage our downloadable advocacy letter and phone script to contact your state legislators. Urge them to support balanced property tax reform that provides relief for families, restores fairness in who pays, and protects strong schools and essential community services. By acting together, we can ensure the Springfield City School District remains strong and sustainable for generations to come.